RPA in Banking – 5 Benefits of Implementing RPA in Banking

- Posted by Adham Jan

- On June 1, 2020

What is RPA?

Robotic Process Automation, often called RPA, enables organizations to easily automate mundane, repetitive tasks in order to free up employees to perform higher value work. RPA covers a wide range of activities and is taking hold in every industry that prizes digital transformation. Let’s learn more about RPA and its benefits in the banking industry.

What is a Bot in RPA?

A bot is a software application that is programmed to do certain tasks. Bots are automated, which means they run according to their instructions without a human user needing to start them up. Bots often imitate or replace a human user’s behavior.

In basic terms, RPA bots are taking over jobs that are usually handled by people; replicating their actions while interacting with application user interfaces. This can be something simple or more complex. For instance, sending an automated email to customers to confirm their account balance as a receipt of their payment is a form of robotic process automation. As the technology evolves, machine learning is able to provide more accurate responses that allow your organization to move manual tedious tasks to an automated model.

Why RPA in banking?

In the banking industry, RPA shows a great value in reducing error, streamlining employee workload, and improving productivity. In any financial institution, there are tasks that have traditionally been handled manually. Even in today’s very digital world, there is still a lot of paper involved in the banking process. New technology and advanced RPA offers your institution more comprehensive tools to improve the customer experience at your branch and via online portals. That’s only one of many RPA benefits in banking you’ll find when you implement a robust robotic process automation system. Learn more about top five RPA trends in 2020

Five Reasons Your Bank Needs to Invest in RPA

In today’s global economy, it’s more important than ever to stay competitive. The financial sector is no different. While we’ve had the technology available to automate many processes for quite a while, RPA is a more advanced technology that can help your institution increase productivity while simultaneously improving employee satisfaction.

Here are 5 RPA benefits in banking:

1. RPA Decreases Repetitive Tasks in Banking Operations

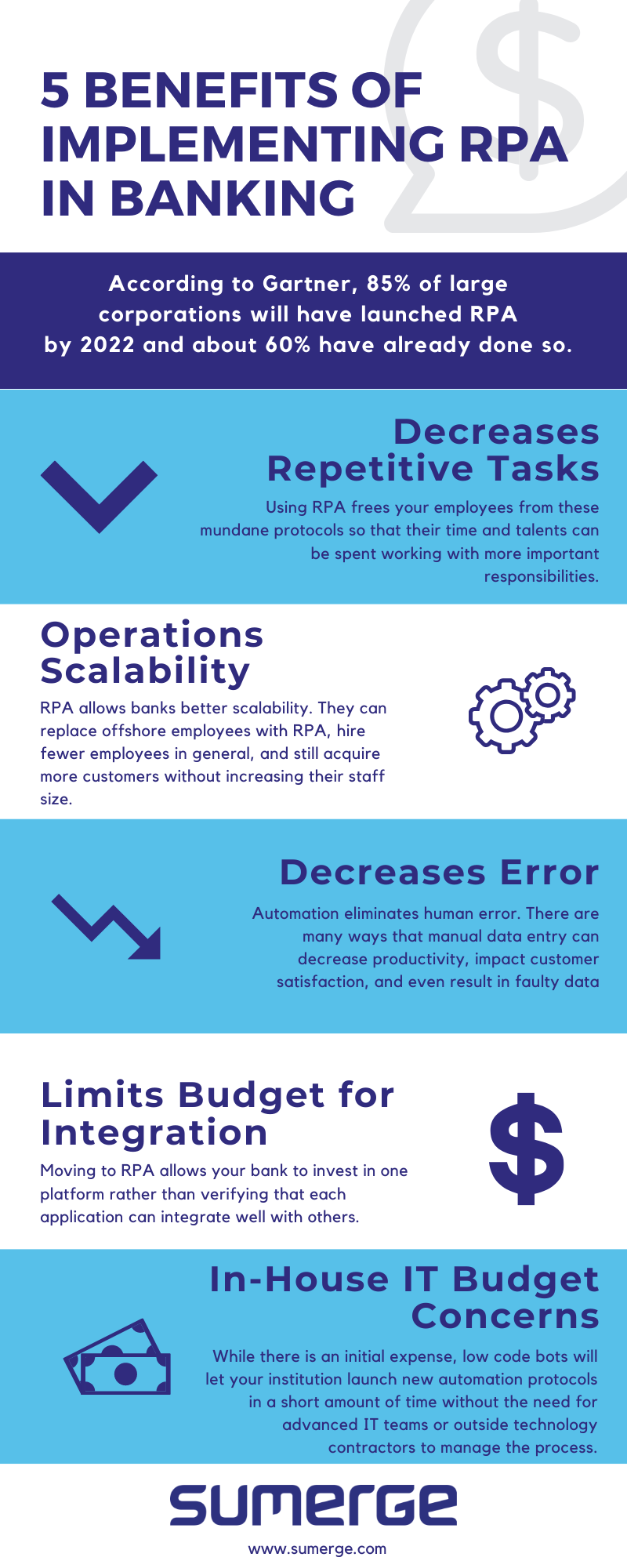

There are many processes within financial institutions that don’t need any special skill or thought. These repetitive tasks are manually maintained, using countless man-hours on tasks that could be accomplished automatically. Using RPA frees your employees from these mundane protocols so that their time and talents can be spent working with more important responsibilities, such as personal customer service.

2. RPA Decreases Error in Banking Operations

Even the best employee occasionally keys in the wrong number. Automation eliminates human error. There are many ways that manual data entry can decrease productivity, impact customer satisfaction, and even result in faulty data. You can entirely avoid these errors through an automated system. The automated system can auto fill already known information without relying on employee time.

3. RPA Limits Budget for Integration

Financial institutions might use a number of different systems and programs, making integration a necessary investment. Moving to RPA allows your bank to invest in one platform rather than verifying that each application can integrate well with others. Often the integration of multiple programs will mean larger expenses for your IT department, as well.

4. Operations Scalability

Let’s talk for a minute about offshoring. For many years, companies across the US used offshoring to keep costs down. That model no longer works well for a number of reasons. The wage gap between the US and the most popular countries for offshoring have shrunk significantly, making it less cost effective to hire employees in these areas. There’s also a large backlash among American consumers who find the customer service lacking and view the organization in a less than favorable light for offshoring jobs that could be managed locally. RPA allows banks better scalability. They can replace offshore employees with RPA, hire fewer employees in general, and still acquire more customers without increasing their staff size.

5. In-House IT Budget Concerns

RPA is not a costly solution in the long-term. While there is an initial expense, low code bots will let your institution launch new automation protocols in a short amount of time without the need for advanced IT teams or outside technology contractors to manage the process.

Interested To Learn More About RPA Solutions? Click Here

With RPA benefits in banking, Is it the right technology for your institution?

According to Gartner, 85% of large corporations will have launched RPA by 2022 and about 60% have already done so. This large move to RPA is because businesses are seeing concrete improvements in performance and efficiency. They also note a drop in overhead expenses and errors.

In the financial industry especially, customer satisfaction is integral to success. If customers see their bank handle transactions efficiently and know that they can get the answer to any questions immediately, it gives them more confidence in the institution.